Most companies enter PE with technology not aligned to scale, governance or value creation. Here’s what we see — and how MSP4PE fixes it.

When portfolio companies enter PE ownership, pressure increases overnight. Growth targets accelerate, governance tightens, reporting expectations rise, and every part of the organisation is scrutinised through the lens of value creation and future exit readiness.

Yet one area consistently lags behind both ambition and investor expectation: technology foundations.

Through years of conducting technology due diligence across dozens of industries, we see the same patterns repeating. They aren’t failures — they’re simply the natural consequences of businesses that have prioritised revenue-first survival and customer-facing innovation over back-office scalability.

This blog outlines the common issues we find, why they matter to investors, and how our MSP4PE Managed Service offering addresses them in ways traditional MSPs are not designed to.

1. The Technology Reality of Companies Entering PE Ownership

Growth-facing tech gets the attention — back-office tech gets the leftovers

Founders and management teams rightly prioritise the systems that generate revenue:

- Customer platforms

- Product and engineering

- Billing systems

- Data needed for commercial operations

These areas receive investment because they drive top-line growth.

But back-office technology — the systems required for collaboration, resilience, reporting, governance, security and operational control — often remains underdeveloped.

This includes the operational foundations that PE firms rely on to run the business at scale.

Why back-office technology matters more during PE ownership

Back-office maturity directly affects:

- Speed of decision-making

- Visibility into performance

- Cyber and compliance posture

- Ability to integrate acquisitions

- Operational margin

- Exit readiness

Poor foundations aren’t always visible, but they compound silently and typically spike during DD, board reporting or integration projects.

2. What We Typically Find During Tech DD

Across sectors, sizes and deal types, three themes repeat:

A. Systems built for operations, not scale

Companies enter PE with platforms that “work” but are not designed to handle the next three years of investment ambition.

We commonly see:

- Disconnected systems

- Weak integration across departments

- No single source of truth

- Limited automation

The business works harder than it should to compensate.

B. Order-to-Cash processes are rarely optimised

There is almost always inefficiency in:

- CRM structure

- Pipeline accuracy

- Quoting and contracts

- Billing workflows

- Accounts Payable

- Collections

- Financial reporting

Automation is limited, and AI is almost never embedded.

For investors, this is significant.

Order-to-Cash controls:

- Revenue recognition

- Margin visibility

- Forecast accuracy

- Working capital efficiency

- Speed of growth

A misaligned CRM or manual billing process can distort forecasts, erode confidence in data, and obscure performance against the investment thesis.

C. Cyber, governance and reporting lag behind investor expectations

Boards increasingly expect:

- Simple, credible reporting of IT risk

- Governance aligned to value creation

- A clear roadmap

- Cyber maturity appropriate for scale

Most firms don’t have these in place yet — not because of negligence, but because the business simply outgrew its IT foundation.

3. Why This Matters to Investors and Management Teams

IT is no longer a support function — in PE ownership it becomes a value function.

If technology cannot:

- scale efficiently

- integrate acquisitions

- provide investor-grade reporting

- support automation and margin expansion

- withstand cyber scrutiny

- prepare for DD

…then it directly affects enterprise value.

Investors need confidence that:

- nothing is hidden,

- IT won’t restrict execution of the value plan, and

- systems will not break under the next phase of growth.

This is where the traditional MSP model breaks down. It was designed for uptime, tickets and SLAs — not value creation, governance, reporting and investor expectations.

4. Introducing MSP4PE — A Managed Service Designed for Private Equity

MSP4PE exists because PE-backed companies need something fundamentally different from traditional IT support.

A. Value Creation and Value Protection

Our model is designed around the two outcomes investors care about most.

We deliver:

- An IT environment aligned to the value plan

- Early visibility of risks before they impact DD or exit

- System standardisation that supports growth

- Governance that enables confident reporting

- Stronger cyber maturity without operational drag

B. Investor-grade oversight

Every service is structured with:

- CTO-level governance

- Monthly RAG-driven reporting

- Action tracking

- Alignment to the value creation plan

- Portfolio-standard templates

This creates consistency across portfolio companies — and clarity for investors.

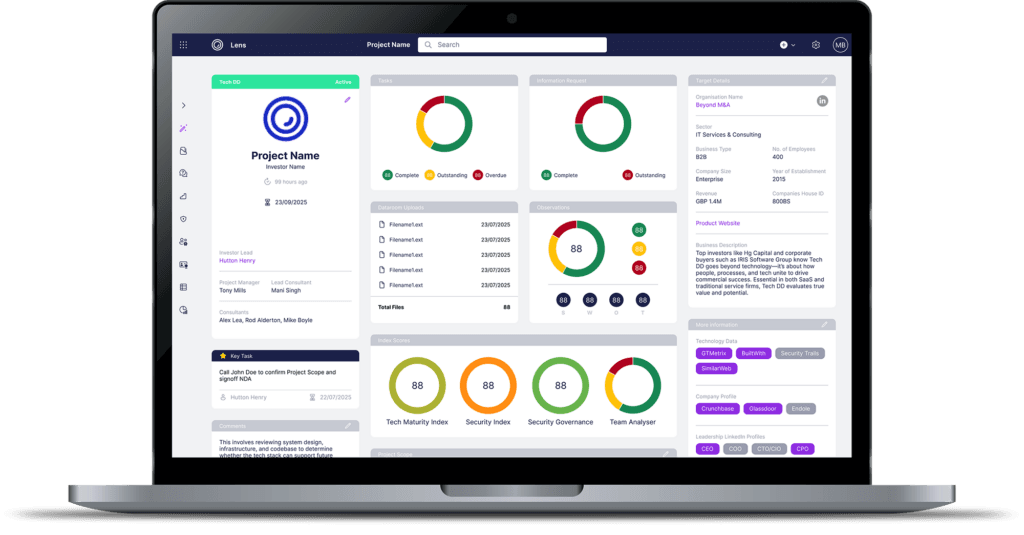

C. LENS: The shared visibility platform

Our platform, built specifically for the entire M&A lifecycle LENS provides a single source of truth across:

- Operational health

- Risks

- Actions

- Cyber posture

- Order-to-Cash maturity

- Investment thesis alignment

It becomes the shared language between management, MSP, and investors. Plus, it has Due Diligence and Post-Merger capability helping your portfolio through its growth.

D. Designed for PE pace

PE timeframes demand fast assessment, clear prioritisation and controlled execution.

We operate to that cadence:

- Weekly operational reviews

- Monthly governance

- Clear ownership

- Efficient remediation

- Transparent reporting

5. What Makes MSP4PE Different

We specialise in PE-backed companies

While many MSPs are generalists, we are built around the needs of PE investors and management teams.

We combine operational IT with strategic technology leadership

This ensures:

- Issues get fixed

- Architecture improves

- Reporting becomes credible

- Growth plans become executable

We look at IT through the lens of enterprise value

Not just uptime.

Issues uncovered during Tech DD are stated in Lens, and then carried over to post-deal operations and managed over the long term. This also means we stand by our findings in Tech DD.

Early identification of risks before they erode value / and with enough time to ensure you can address before your next exit.

Your Portco internal IT is aligned with the business’s investment thesis.

6. The Most Common Objections (and Our Responses)

“We already have an MSP.”

Most do.

MSPs fix tickets and keep things running — MSP4PE overlays governance, reporting, cyber maturity and value alignment.

“We already have a CTO.”

MSP4PE frees your CTO from operational noise so they can focus on product, engineering and the growth plan.

“We don’t want to add cost right after investment.”

Unoptimised IT, unreliable reporting and manual processes cost far more — in margin leakage, slow decisions, unclear forecasts and DD surprises.

“We’re scaling too fast to slow down for IT improvements.”

This is exactly when foundational issues become painful.

MSP4PE stabilises operations while enabling responsible scale.

7. Q&A

Q: How quickly can we see value?

Within the first 30–60 days, governance, visibility and prioritisation improve dramatically.

Q: Does this replace our MSP?

Not necessarily. We can work with your existing MSP or operate as a fully managed service. But note our PE reporting and tooling which helps keep tack of governance and maturity would not be available.

Q: How does this support the investment thesis?

We align IT architecture, reporting, automation and cyber maturity directly to the growth plan.

Q: What size companies benefit most?

Generally £3m–£100m revenue companies entering or within their first PE cycle.

Q: Can this support buy-and-build?

Yes. Standardisation across systems, governance and reporting significantly accelerates integrations, and our SaaS product Lens is built to help manage post-merger integration projects.

Q: Isn’t there a conflict of interest

Our MSP team is completely separate from the DD team, with no overlap in mandate or incentives.

We also want you to know that we also take great care not to use any specialised insight or deeper awareness gained through diligence to advance our own commercial interests. Our role is to provide an objective, unbiased assessment—never to leverage confidential understanding to grow our MSP business. Our reputation depends on that clarity and integrity.