I’ve always believed there’s a thread that links founders, sportspeople, and artists. We’re often lone operators at the beginning — ego-driven, idealistic, and obsessed with changing the world. Until we build the resources (and humility) to form a team, it’s just us, head down, charging forward.

And even when we do have a team, we founders still struggle to fully let go. We don’t delegate; we tolerate. But hey — that’s a different story.

As someone who used to write software and now writes scripts as a creative outlet, I’ve started to see strong parallels between coding and screenwriting. They both begin the same way: staring at a blank page. You dive in with a feeling or an intention. And if you’re lucky, you hit “the zone”. That incredible flow state where hours fly by, dopamine’s pumping, and by the end of it you’ve built something — a film scene or a new SaaS module.

That’s the magic moment.

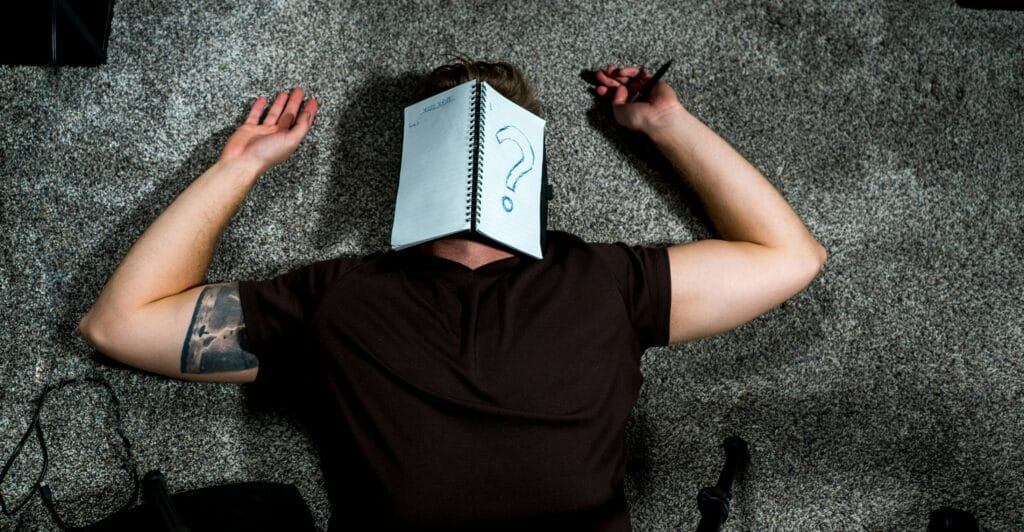

But what happens when it doesn’t come? When the code doesn’t flow, and the ideas feel… stuck? Can software developers get writer’s block?

For a long time, I didn’t think so. Software feels instantaneous. If you’re stuck, you hit Stack Overflow, grab a ChatGPT prompt, or refactor something safe. But I’ve come to realise that the block doesn’t show up in the code — it shows up before the code. In the concept stage. At the product level. In the team’s heads.

Writer’s Block in Product Development

Case in point: on one of our internal SaaS products, we spent nearly a year paralyzed between two core ideas — AI features, and adding SSO. Both sound simple, right? But the debates dragged on endlessly. AI felt too big, too undefined. SSO, for some reason, felt like a security headache. The Kanban board grew dense. Our roadmap became more like a roadmap of depression.

The team — and I say this with hindsight — didn’t want to try. They had internal biases. We weren’t honest about them. Instead, we went through the motions: meetings, planning, cycles, no real progress.

Eventually, I did what felt radical: I shut the project down. Took a real break. A long one. Over a year.

When we came back, I gave a junior dev the lead. He stepped up. Within weeks, both features were in. Neither perfect. But the product? It’s finally great.

The Power of the Pause

The break gave us something that bootstrapped companies rarely admit they need: perspective. We stepped back and asked the existential stuff:

- Are we happy just running a service business?

- Do we still want to build something exciting?

- Is this product still ours?

And it became clear — no, we’re not here to be passive. We want to be in the arena. With our clients. With skin in the game.

That reflection, that hunger? It doesn’t come from sprint planning. It comes from stepping away. Letting the dust settle. Getting bored enough to get dangerous again.

Now the team is flying. We’re lean, excited, hungry. And yes — we’re bootstrapped.

What If We’d Been Funded?

Here’s a question for the investors out there:

Would a VC-backed team have been allowed to take that break?

To pause for a year — no movement, no releases, no story to tell — just to come back with more focus and momentum?

Would they have been allowed the breathing room to avoid wasting two years faking productivity?

I doubt it.

And that’s where I think founders and investors need a new conversation. One about permission. About timing. About recognising the early-stage “product block” for what it really is — not a failure to deliver, but a deeper creative stall. Just like a screenwriter who can’t find the next scene.

If you let it sit, something better often emerges.

If you don’t, you burn a year in meetings and OKRs that mean nothing.