To some, Agent-based AI is a buzzword, to others, they are already commercialising it. Instead of discussing the technology from afar, I will describe the use of Agents by taking you through a simple use case and then referring to a strong example of usage from a firm we did Tech DD on.

I have a simplistic view of the tech itself – an agent will perform a specific task it is built for, in a particular sequence, to provide a specific output. This has been at the core of computing since it emerged, but wrapping AI and models makes these small modules very useful.

AI agent startups secured $8.2 billion in investor funding over the last 12 months, spread over 156 deals, an increase of 81.4 percent year over year, according to PitchBook data.

Difference between Chat AI and Agentic AI

To save time, I used Chat AI to answer this:

Chat AI: Designed for interactive conversations, Chat AI works like a dialogue partner. You give it input, it responds, and you can refine the output by continuing the conversation. It’s iterative and flexible.

Agent AI: Focused on completing a specific task autonomously, Agent AI follows a set sequence of actions to deliver a defined output. You provide instructions, and it completes the job in one go without ongoing interaction.

Key Difference: Chat AI is conversational and iterative, while Agent AI is task-oriented and operates in a “one-and-done” style.

Agentic AI example

I first came across Agenti AI when Dharmesh Shah, co-founder of HubSpot, mentioned he’d been coding until 2 am on something ‘exciting’. It was pleasing to see that someone who doesn’t need to work, I assume, still has the passion and energy to be a tech adventurer.

Dharmesh then released ChatSpot AI, a text/AI input into HubSpoit, and not long after, Agent.ai, where he paid for “the most expensive domain name ever for a totally free newsletter with no monetisation plans whatsoever.

Trying something new that's a bit…out there.

— dharmesh (@dharmesh) November 13, 2023

I'm noodling and tinkering with a new (free) hobby project called https://t.co/t8qEJJTSUi.

Because I (and others smarter than me) think agents are where A.I. is headed.

But, I believe in building community alongside product.… pic.twitter.com/ra9Vn5SlCK

That was back in November 2023; a lot happens in the tech industry in a year.

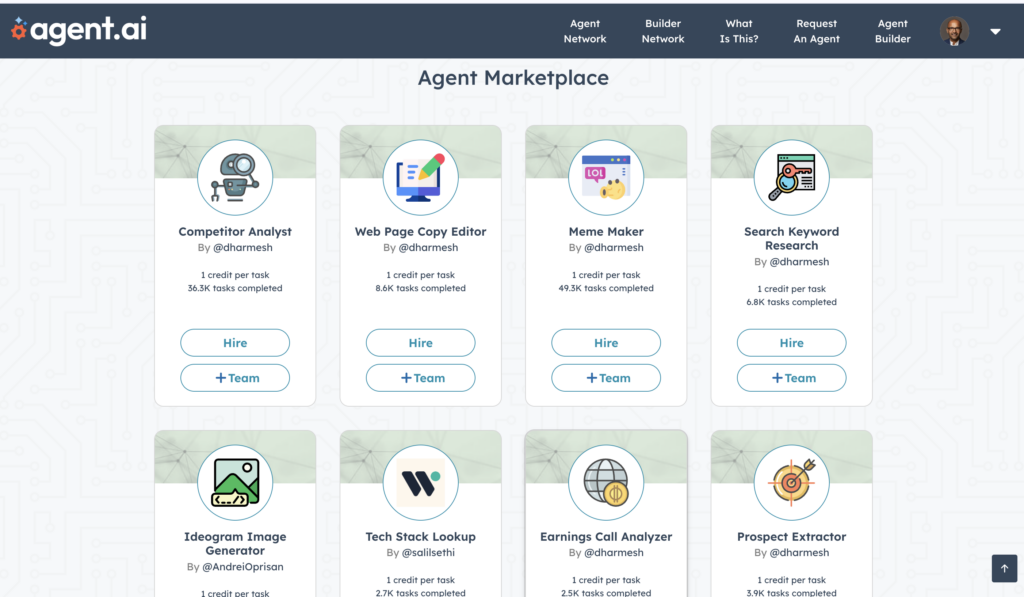

Since that post, Dharmesh has turned the product into an Agent Marketplace. Such a brilliant idea, as this brings the power of community together and crowdsourcing thoughts and application of the technology.

You can read more about his journey here: https://simple.ai/p/secret-behind-agent-ai

To see Agentic AI in action for this post, I ‘hired’ the blog-writing agent:

To write the following section:

What is Agentic AI?

Agentic AI refers to AI systems that possess a degree of autonomy and decision-making capability, enabling them to perform tasks with minimal human intervention. Unlike traditional AI models that require explicit instructions and constant oversight, Agentic AI can adapt, learn, and make decisions in real-time, much like a human agent. This capability opens up a plethora of applications, from autonomous vehicles and personalized healthcare to dynamic financial modeling and beyond.

For VC and PE investors, the rise of Agentic AI presents a massive opportunity to capitalize on the next wave of technological innovation. The potential for Agentic AI to disrupt existing business models and create new markets is immense. Companies that harness this technology effectively can achieve significant competitive advantages, making them attractive targets for investment.

One of the key areas where Agentic AI is poised to make a substantial impact is in the automation of complex processes. In industries such as manufacturing, logistics, and supply chain management, Agentic AI can optimize operations, reduce costs, and enhance efficiency. By investing in startups and companies that are pioneering these applications, investors can tap into a growing market that is set to revolutionize how businesses operate.

Moreover, the healthcare sector stands to benefit enormously from Agentic AI. With its ability to analyze vast amounts of data and make informed decisions, Agentic AI can improve diagnostic accuracy, personalize treatment plans, and streamline administrative tasks. This not only enhances patient outcomes but also reduces operational costs for healthcare providers, making it a lucrative area for investment.

Financial services, too, are ripe for disruption by Agentic AI. From algorithmic trading and risk management to fraud detection and customer service, the applications are vast and varied. By investing in companies that leverage Agentic AI to innovate in these areas, investors can position themselves at the forefront of a financial revolution.

My thoughts on this specific use of Agent.ai

The output is OK, fitted the bill but missed some of my requirements and, unlike the Chat equivalent I could not keep talking to the agent to refine the output.

However the content was useable if not refined.

A considerable way computing has changed with AI is how easy it is to navigate, with less UI (User Interface) and more text input. This is referred to as ‘Chat UX’. For example, this was the entire UX (User Experience) to ask for the blog to be written:

‘Hiring’ an agent was a novel concept, taking the Fiver and UpWork model to a different realm where the worker is electronic and doesn’t pitch for the work (yet). If you’re used to hiring people from freelancer marketplaces, I think you’ll be right at home here.

Investor considerations

Dharmesh does not need funding for this platform, but given its current state, it represents what a VC might be investing in – concept and tech build are complete. I am analysing this very quickly, from a far, and doing this to (a) highlight Dharmesh’s creativity and (b) how the SaaS model can be disrupted.

I have not used the platform extensively, but let’s be honest, that’s how all end users judge a platform – they expect high value for little input. So, I have not dug into how to use the system more effectively.

I am also very aware that the system is relatively new yet far ahead of others. That means there are probably 101 ideas on improvements on Dharmesh’s backlog.

Pros

- Investment candidate: Agent.ai has the potential to fit the Google ‘toothbrush’ model. Google only acquires firms that provide solutions its users depend on; like a toothbrush, they must be used at least twice daily and vital. Depending on the output, there’s a chance this could be vital.

- Ease of use: There is little friction to using this type of platform. Like ChatGPT, you need to register an account, and you’re ready. I got value within less than five miniutes, no paywall and no salespeople involved.

- Power of People: Dharmesh quickly gained interest from end-users and marketplace ‘sellers’. But unlike the freelancer marketplaces, the content and IP of ‘seller’ is on the platform itself.

Challenges

- Get the use case right: For blog writing I am used to ‘chat’ to refine a prompt, but agentic AI is more a ‘one and done’ orchestration of a sequence of tasks to get a single output. This is why my tect above does not sound like me. But the real probkem is that you need a singular task, so I hired another agent below to compare.

- Transparency: I am asking an agent to do soemthing for me but I don’t know how it’s doing it. But that’s not much different to hiring someone on Fiver etc.

A more unique and specific agent on Agent.ai

Given that blog-writing is really a chat-focused task, that needs constant refinement, I gave the platfrom a second try by hiring the ‘Recent LinkedIn Posts’ agent:

With very little input:

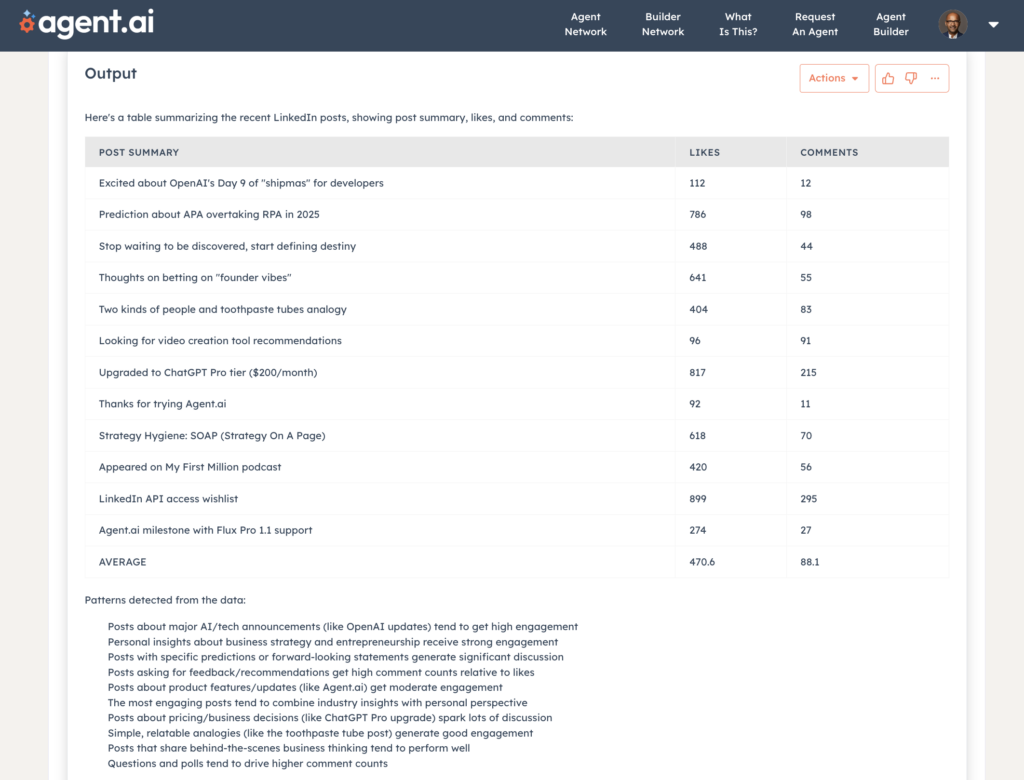

I got some great results, which feel much more aligned to using agent technology. As you can see, the agent reads 10-12 posts, analyses the responses, and then summarises some of the key topics. It is very handy for a sales meeting and impressively quick.

This is a better example as the agent clearly is automating a sequence of tasks (reading posts, analysing the responses and summarising the writer’s main topics):

Agent AI in Industry – Puma Growth Partners £11m deal with Aveni

We worked on the Puma Growth Partner’s led £11m deal for AI firm Aveni, providing Technology Due Diligence during the deal.

By leveraging Agentic AI, Aveni enables financial advisors to focus more on client interactions, while the AI handles routine tasks with minimal human intervention. This integration exemplifies how Agentic AI can streamline operations and improve service delivery in financial services.

Aveni incorporates Agentic AI into its solutions, particularly through their AI-powered assistant, Aveni Assist. This platform automates administrative tasks in the financial advice sector, such as CRM updates, report generation, and client communications, operating autonomously to enhance efficiency and productivity.

Aveni was one of the stand-out assessments this year; our entire team has continued to talk about it and use it as a comparison firm when we look at AI targets.

Agent AI-driven value creation

During the technology due diligence interviews, it was clear how valuable this platform was, and therefore, the underlying AI was for the end users. A financial advisor meets a customer and interviews them; the Aveni platform uses carious models and AI techniques after the interview to provide advice and suggestions. I cannot and won’t offer any more detail than this, but the automation = speed = resulting in value and efficiency.

The power of orchestration

What really stood out to me within Aveni was the orchestration of technology. Brilliantly thought out and smoothly executed. I’ve built a few orchestrations in my time and it was exciting to see this in action using the latest AI techniques.

AI orchestration is an evolution in automation, combining multiple AI capabilities into a seamless system. This represents an opportunity for investors to back companies that can deliver high-value outcomes efficiently, scale quickly, and adapt to evolving market needs. In this case – Financial Services – one of the most regulated markets in our industry. If that isn’t a rubber stamp for AI Agents I don’t know what is!

Why AI Orchestration Creates Value for Investors

- Efficiency & Scale:

Orchestration allows businesses to automate complex workflows, reducing time and cost. Instead of piecing together individual AI tasks manually, orchestration creates a unified process that scales effortlessly. - Higher ROI:

By leveraging multiple specialised AI tools, companies extract more value from their technology stack. This reduces inefficiencies and increases productivity—key drivers of growth for investors. - Enhanced Decision-Making:

Orchestrated AI systems can pull insights from vast datasets, combining analytical models, automation tools, and decision-making agents to produce actionable recommendations, improving outcomes in industries like finance, healthcare, and logistics. - Competitive Differentiation:

Companies using AI orchestration gain a competitive edge by delivering faster, more consistent, and higher-quality results. This makes them attractive targets for acquisition or investment. - Adaptability:

Orchestrated systems are modular and scalable. As new AI technologies emerge, they can be integrated seamlessly into existing workflows, ensuring companies stay agile and innovative.

The power of people

As our core value is ‘People First,’ it’s essential to highlight that none of this works without knowledgeable people steering the ship. It’s not just about understanding the technology but having deep expertise in the business, industry, and processes—and pairing that with creativity and ingenuity. These AI agents are only as effective as the people shaping and guiding them.

In both examples (and though I’ve not met Dharmesh—maybe one day), what stands out is the presence of exceptional thinkers. That’s what you’re investing in: the brilliance behind the innovation. And that’s what I love about AI—the way it rewards passionate, visionary minds.

Conclusion

I hope my two working examples demonstrate that Agentic AI is an area that is already commercialised and providing value. It represents a massive opportunity for VC and PE investors to drive value creation and capture significant returns.

As this technology matures and integrates into various sectors, those who recognise its potential early and invest strategically will likely reap substantial rewards. The future of AI is agentic, and the time to invest is now.