Technically? Yes.

Strategically? Not Really.

Let’s cut to it.

Yes — it’s entirely possible for a company to prepare itself for due diligence. You can gather data. Fill in the gaps. Build a pack. Use checklists. Even run internal reviews.

But in the UK, that isn’t enough. We operate in a “buyer beware” legal environment. So when it comes to real diligence, the investor (or buyer) has to critically assess your business for themselves. They need to reassure their Investment Committee, their LPs, and their conscience that this isn’t just marketing polish — it’s real.

Self-serve due diligence doesn’t hold up when it’s time to sign a term sheet.

Because you can’t audit yourself and expect anyone to take it at face value.

And that’s fair — they’re putting real money at risk.

But that doesn’t mean there’s no value in doing the work anyway.

Most Companies Are Flying Blind

The truth is, most companies aren’t raising this quarter.

Many won’t raise at all this year. Some aren’t even on the radar of PE or VC yet.

And so, they miss out on the forced clarity that investor scrutiny brings.

But what if you could get that clarity anyway?

What if you didn’t need to raise capital to get PE-level governance insight?

The biggest gap in most companies isn’t capital — it’s awareness.

They simply don’t know how they’d look under the spotlight.

Why You Should Prepare Before You’re Under Pressure

It’s surprising what risks founders operate with. Waiting until due diligence is on the table is risky.

By that point, the clock’s ticking. And if your house isn’t in order, the best case is a painful close. The worst case? A pulled deal or a down-round excuse.

Here’s the smarter move:

Know now.

Fix things while no one’s looking.

Run your business at a level that expects attention — even if it’s not coming yet.

This isn’t about dressing things up.

It’s about operating better. Leaner. Smarter. Sharper.

Enter: Lens

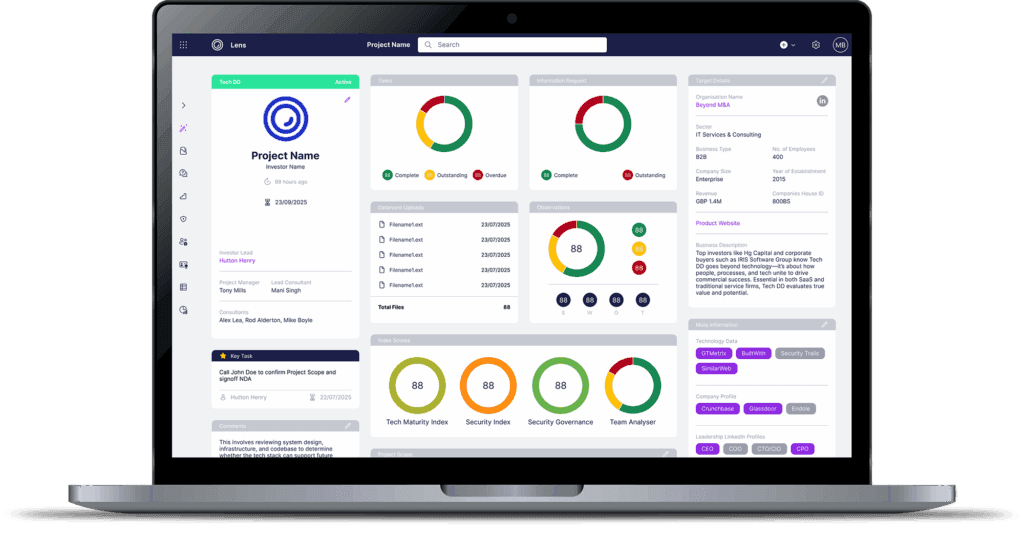

We built Lens to solve exactly this.

It’s a self-serve platform that shows you where your business stands — from a private equity and institutional investor perspective.

No fluff. No guesswork. Just a clear readout of what’s working and what needs attention.

It doesn’t replace formal diligence. It’s not meant to.

It’s preparation — the good kind.

The kind that costs less than £100 and gives you a proper perspective on where you stand.

You get:

- A structured view of your operations, tech, people, and strategy

- Gaps identified with PE-style precision

- Confidence that you’re not building blind

All without spending tens of thousands on a full diligence process.

👉 Try it now: https://lensapp.ai

Raise Your Game — Even If You’re Not Raising

You don’t need a deal to level up.

You don’t need a buyer to take governance seriously.

And you definitely don’t need to wait for an investor to show up before running your business like a pro.

Lens is for founders and operators who want to lead like they’re already being watched — and grow like they’ve already been funded.

And when the day comes that you are raising?

You’ll be more than ready.

Not Convinced? Consider these Questions.

- If a strategic buyer called tomorrow, could you move in 14 days?

- What signals are you not sending to the market by avoiding professional self-assessment?

- What’s the cost of running blind for another year?