Over lunch with some smart co-founders recently, I saw a common but costly mistake unfold in real time. They’ve got a cracking off-market deal: already hitting seven figures, strong tech that’s proven in-market, and a foundation that could support much wider usage. They’re gearing up to raise investment — and rightly so. This is a serious opportunity.

But when it came to how they pitch? They shrank it.

They focused only on their direct customer — not the consumer, not the wider ripple effects, and definitely not the upside of their own business. It was a textbook example of what many UK founders do: play it down, keep it modest, make it all sound very “realistic.”

And sure, there’s something reassuring about a grounded pitch. But when you lead with limitation instead of opportunity, it doesn’t light up an investor — it dims them.

The Trap of the “Realistic” Pitch

Here’s what they said:

“Our customer just wants to make more profit. They are not worried about other factors such as customer ”

I get what they were trying to do – to demonstrate they know their customer, the reality of the buisness in their industry and show they know their market. The problem is it’s a bit drab and doesn’t instil excitement.

That kind of framing makes it sound like a solid service business. But the reality is, they’ve built something much bigger — a B2B2C model with serious consumer pull and platform potential.

It’s just that none of that made it into the story.

By trying to sound credible, they missed the bigger truth: their product creates a flywheel of value across three stakeholders. And when you leave that out, investors don’t just miss the upside — they may question whether it’s even there.

The Shift: Pitch it in 3D

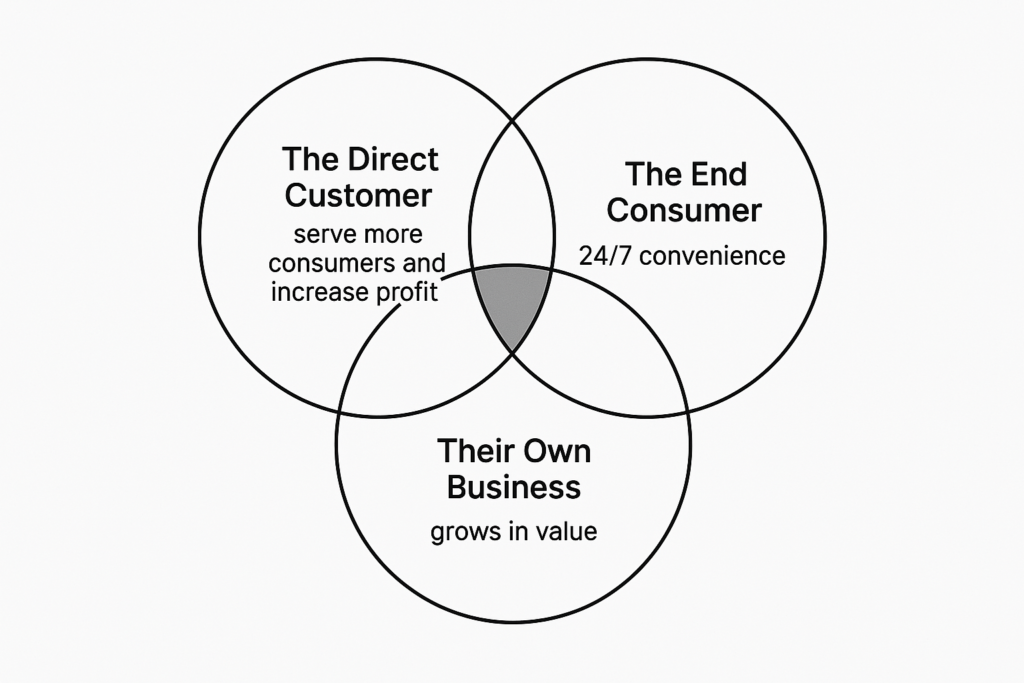

So I suggested a simple reframe: draw a Venn diagram. Three circles. Three wins.

- The Direct Customer – gains new revenue streams by reaching more consumers.

- The End Consumer – gets always-on convenience, the same way Netflix disrupted appointment TV.

- Their Own Business – grows in value by enabling the above at scale.

The overlap is where the magic happens:

- More consumers drive more demand.

- More demand means more revenue and insight.

- That momentum builds a much bigger business than a single customer relationship ever could.

This isn’t just helpful for investors — it’s also a moment of clarity for founders. It reframes the venture from “helping a customer do X” to “unlocking growth across an ecosystem.”

The Takeaway

Investors don’t just invest in product-market fit. They invest in opportunity. In ambition. In models that scale.

A pitch that only focuses on what the customer wants today might feel credible — but it can fall flat. It leaves too much unsaid.

By showing the win for the customer, the consumer, and your company, you tell a bigger, braver story — one rooted in interdependence, growth, and shared success.

That’s what excites investors. That’s what unlocks capital.

And sometimes, all it takes is a simple diagram.

Three Questions to Ask Before You Pitch:

- Does your pitch clearly show how each stakeholder wins — and how that drives growth?

- Are you highlighting upside, or playing it down in the name of realism?

- What would your Venn diagram look like — and are you putting it in front of investors?