At Beyond M&A, our core service is assessing companies for investment and buyout. We sit in boardrooms, sift through codebases, and help investors make high-stakes decisions with confidence.

But here’s the truth: we never wanted to be clipboard-holding auditors. That’s not our style.

We believe in being on the same journey as the companies we assess. That means we don’t just review products—we build them. We don’t just look for red flags—we’ve lived through them.

We’re not on the outside looking in. We’re in the trenches too.

Why That Matters

Because when we’re building, we hit the same questions you do:

- Is this actually solving a real problem? (Product-Market Fit)

- How do we sell this without overhyping it? (Marketing & Commercialisation)

- Why are we doing this again? (Motivation, especially on the hard days)

That emotional rollercoaster? We know it intimately.

From the euphoric highs of a great demo day, to the troughs of doubt at 2am.

From grand plans that unravel, to quiet pivots that finally land.

And we believe that empathy makes us sharper, faster, and better at what we do for you.

The Pivot: Building for Founders, Not Just Investors

We realised that while our service offering is tailored to investors, our SaaS platform had to pivot towards founders.

Why?

Because we kept seeing the same gap—founders entering critical negotiations without the tools, language, or prep they needed to show up polished and investor-ready.

So we’re fixing that.

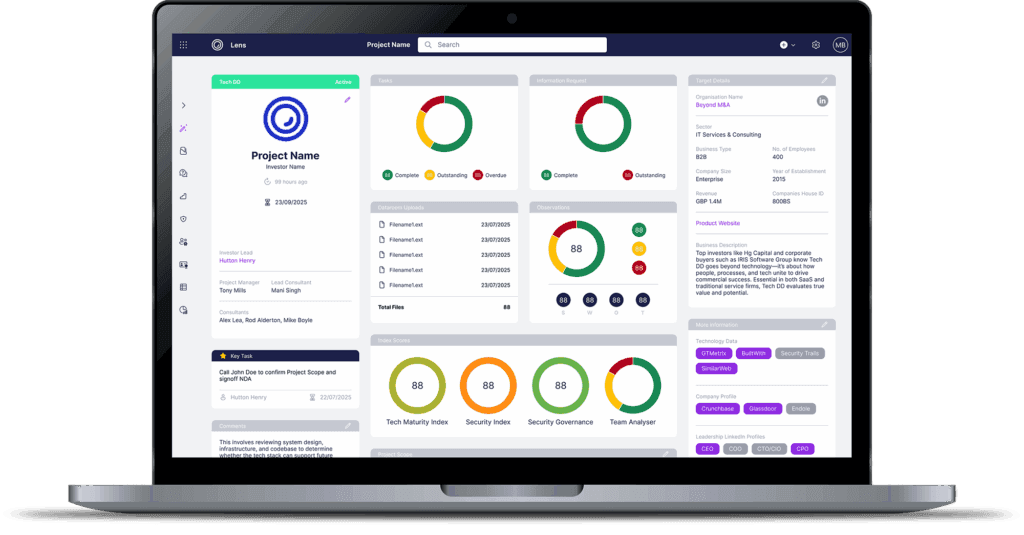

What We’ve Built: A Data Room on Steroids

Think of it like this:

📦 A data room — but not just a dumping ground for folders.

🧠 With coaching — to help you understand what’s needed for every funding round.

🧪 With self-assessment — so you can pressure-test your own readiness before anyone else does.

We give you due diligence screens based on real investor expectations, mapped to the key areas that matter. And yes—we’ve validated it with actual investors.

They’re not just okay with it. They love it.

Why? Because they’d much rather meet a well-prepared, high-trust founder than spend time untangling a mess.

Maximising your outcome drives us.

We’re building for founders who want to level up—without losing themselves in the process.

We’re not chasing hype. We’re building tools that help people show up as the best version of their business.

Founders don’t need more pitch decks.

They need clarity, confidence, and agency.

And that’s what we’re here to give.

Three Follow-Up Questions:

- If you assessed your own business today, what would score highest—and lowest?

- Are you preparing for your next raise reactively or proactively?

- What would be possible if your next investor meeting felt like a formality, not a gamble?