I had an insightful conversation with an investor today—someone with a technology and data background who has recently transitioned into investing. Having worked with multiple Tech Due Diligence (Tech DD) providers in the past, he shared two key observations that stood out.

“Tech DD is Expensive.”

I get it. Before I founded Beyond M&A, Rod and I worked for a firm where we acquired and integrated over 70 smaller companies in just two years. It was an incredible experience, but we quickly noticed that management consultancies often charged hefty fees, relied on cookie-cutter processes, and applied blanket pricing structures that didn’t always align with the complexity of each deal.

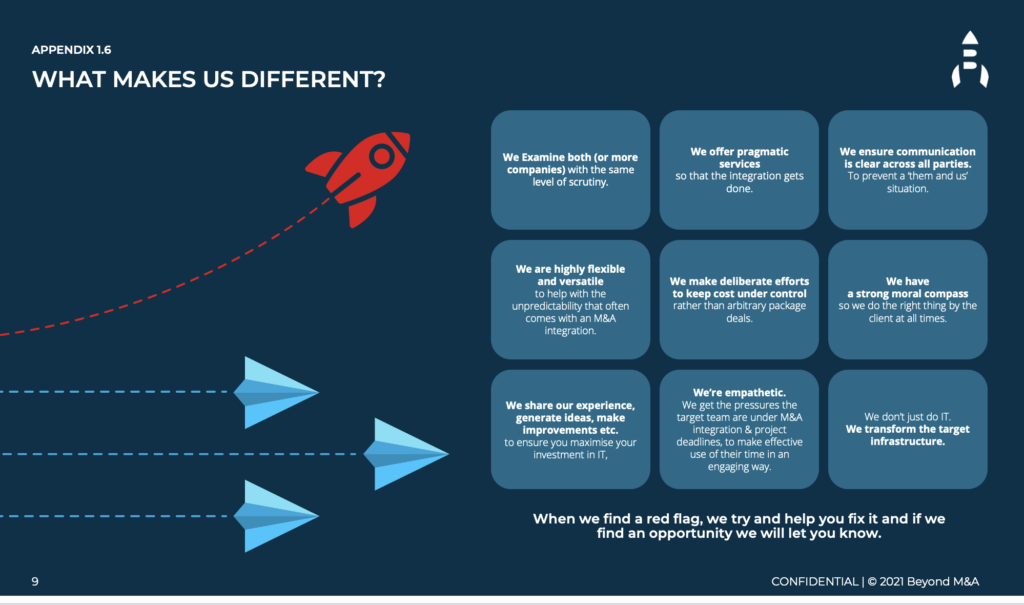

That’s why we built Beyond M&A with a different ethos:

Play the long gAme. We offer pragmatic services, keep costs under control, and communicate clearly with all stakeholders. We’re flexible, we share our experience, and we don’t just assess IT—we help transform the target infrastructure.

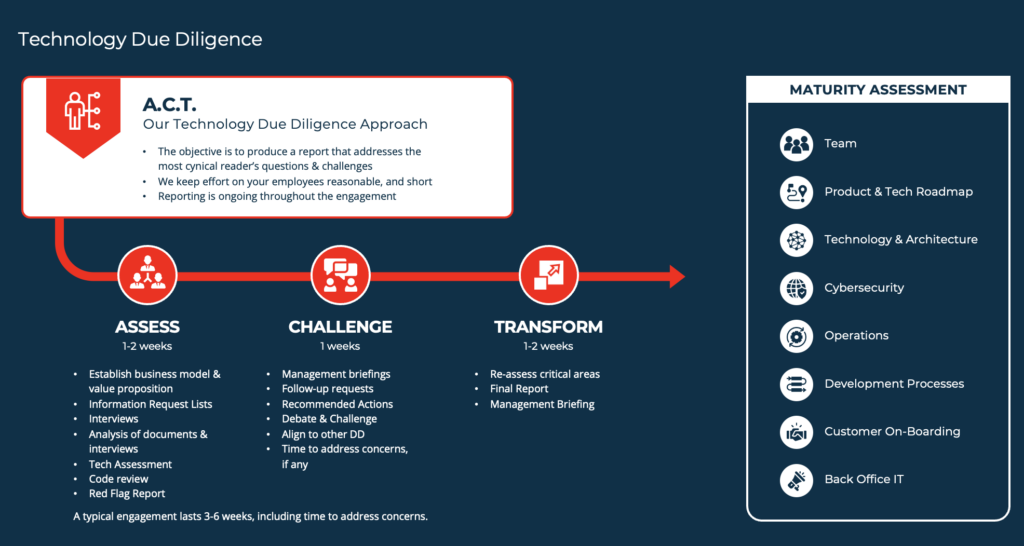

One significant shift in the industry is the rise of two-phased Tech DD. Tech DD is no longer just a hygiene factor at the end of a deal—it’s now a key part of the early-stage decision-making process. By conducting a broad initial check at the start of the deal, we help keep costs down while ensuring investors can identify risks early.

“Tech DD Overcomes a Language Barrier.”

The investor also highlighted a common challenge:

“We understand technology from a high level, but we don’t always understand what the target company is really saying.”

This is exactly why clear communication is at the heart of our Tech DD process.

My background as a screenwriter has helped shape how we approach Tech DD. Strong narrative and storytelling—without unnecessary tech jargon—makes all the difference. Investors don’t just need a technical breakdown; they need a cohesive story that aligns with financial plans and investment theses.

At Beyond M&A, we make sure our reports translate complex technical realities into actionable insights that investors can actually use.

By eliminating the language barrier between technology and investment, we help investors make more confident decisions—whether it’s spotting red flags or identifying opportunities others might miss.