90.27% of Tech Employees Act The Same Way

We work with teams when they receive investment from Private Equity or are being integrated post-M&A.

Over a couple of years, we have assessed over four hundred technology staff as part of our role. As part of this, we use a psychoanalysis tool – the Kolbe Index.

This has allowed me to judge diversity in tech based on data.

We were collecting data on people’s conative behaviour. In layman’s terms, we test how people act under stress or in a creative zone.

We didn’t expect the pattern – within technology teams, 90.27% of people act the same way.

You are hiring Clones.

We saw the same results regardless of age, gender, ethnicity or size of business (corporate, start-Up or mid-Sized). And, likely, you are also hiring “conative clones”.

We found conative similarities across team members of all types, regardless of role. For example, those that write cutting-edge software maintain IT infrastructure or even a team of nomadic software developers who travel the world.

Most of the people we assessed are “Fact Finder/Systemisers”.

They begin projects by collecting data. Following that, they devise a system of how they will work before they get to work.

This behaviour sounds perfect for technology teams – until you understand :

(a) These people who, under stress, will predominately collect data

(b) Too many team members act the same way means there’s no challenge to the status quo.

(c) with no challenge to the status quo, Fact Finders will reinforce behaviours (positive or negative). The change will occur very slowly, if at all.

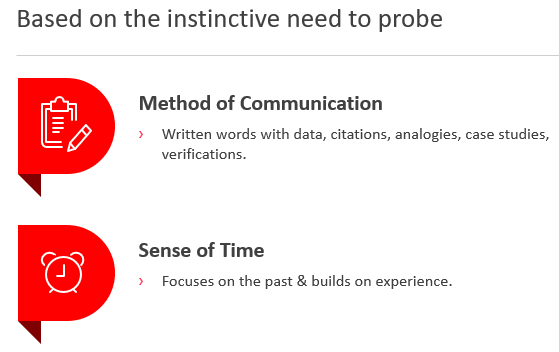

A summary of their communication style and sense of time is described below:

It means that they will often,

- Fall into the trap of “analysis” paralysis. We’ve repeatedly proven this with our clients by running interactive exercises with the team.

- Find it difficult to deal with intangibles. Their sense of time is based on the past to build the future. Innovation is often based on intangibles.

- Struggle to align with the business plan

So I don’t see the tech employees as the issue. It’s the hiring processes and the lack of conative diversity that is my concern. A lack of differences in how employees think is a hidden problem contributing to the diversity in tech problems.

Begin to fight the stereotypes

If you have a team that is 90.27% of “Fact Finders”, your tech team show the following characteristics:

- Technology Employees are Poor Communicators.

- The business Struggles to be “understood” by tech people.

- Tech Teams fall into “silos.”

People tend to believe these are stereotypical weaknesses in the tech team. Even popular TV shows depict awkward technology experts who communicate poorly.

For example, look at “The IT Crowd” or any hacker depicted in a feature film other than Mr Robot. (The anomaly is when a successful tech entrepreneur is shown in the news. In that situation, they are smartly dressed, pushy and “visionary”)

To break the stereotypes, we need to understand the standard method of communication and sense of time for a “Fact Finder”.

And recognise the need for Fact FInders to work with a mix of people. For example, to add those who naturally act differently, i.e. conatively diverse.

To help address these problems, we need to:

- First, assess our bias for hiring people of the same “type.”

- Then, mix it up – hire people of different conative abilities.

- Mix-“in” the business and gain conative diversity through additional people outside the tech team.

If technology leaders know this information, they can design their teams accordingly. In turn, they will be directly addressing their diversity in tech challenges.

For example – mix in some Quick Starts.

To help you understand this better, I will describe another type of thinking.

Conative Quick Starts are typically the polar opposite of Fact Finders.

They naturally deal with intangibles, prefer to communicate in person/on the phone and naturally take risks.

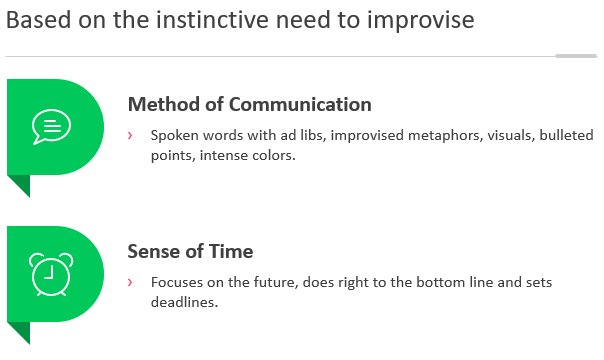

To compare, here is their; preferred communication style and sense of time. As you will see, they tend to think of the future and communicate differently:

If you introduce Quick Starts into a team of Fact Finders, they are likely to challenge the team’s behaviour.

- Instead of working solely on the past, a Quick Start looks to the future.

- Instead of communicating via e-mail and the written word, Quick Start is likely to promote in-person or telephone conversations.

- Instead of falling into “analysis paralysis”, the team is more likely to be more effective.

And it works both ways.

If you hire a predominately Quick Start team, mixing in a couple of Fact Finders will create more stability.

The problem is Quick Starts in technology teams are rare. So here we are discussing this very subject with a team of software developers from Silicon Valley:

I share that photo as the team was approx 70 people, and yet they only had one Quick Start at the time. To make matters worse, this Quick Start was seen as an ‘odd character’ due to his behaviour. Hence management put him on special projects.

In this example, the tech leaders have a high EQ (hence the extensive Kolbe assessment). But they still presented the biases contributing to the Diversity in Tech problem.

By highlighting the biases, we could work together and see how management could design more diverse teams.

How conative assessments can address the Diversity in Tech issue

Your behaviour will depend on what you have been exposed to in the past and your personal and social values. To fully understand a person’s behaviour. We need to assess their conative behaviour in three areas – their personality, their cognitive ability and what I’ve been focusing on in this post.

What is “conative”? In short –it’s the natural way that you act under pressure. Conative behaviour is down to the individual; it doesn’t change from the age of six and is not impacted by age, race, gender etc.

Diversity is everywhere

I’m pretty diverse at my core and from a cultural perspective for those who don’t know me. My origins are from the Caribbean. I look Indian; from age 5, I lived with Caucasian parents – true cockneys who were born close to the Bow Bells.

They sent me to a predominately Jewish School. I remember singing “Shalom Chaverim” daily at assembly – a passionate way to start the morning.

I’ve never had an issue getting a job in technology and never felt that there was a limiting “ceiling” above me, although to ensure I didn’t experience discrimination.

I did one thing to comply with the workplace – I rapidly discarded my cockney accent.

On a serious note, I learned the best thing to do was to take the best from each culture, and mixed teams and cultures are best if you can build them.

The Diversity in Tech issue is being addressed.

I’m suggesting that the diversity issue is more significant than we think.

The teams we work with are already ‘diverse’ regarding age, race, gender, etc. But from our testing, they all think and work similarly.

The statistic of 90.27% of tech team members being predominately Fact Finders is a testament to that.

And I conclude that we need to change our hiring processes to address the Diversity in Tech issue and create more effective teams.