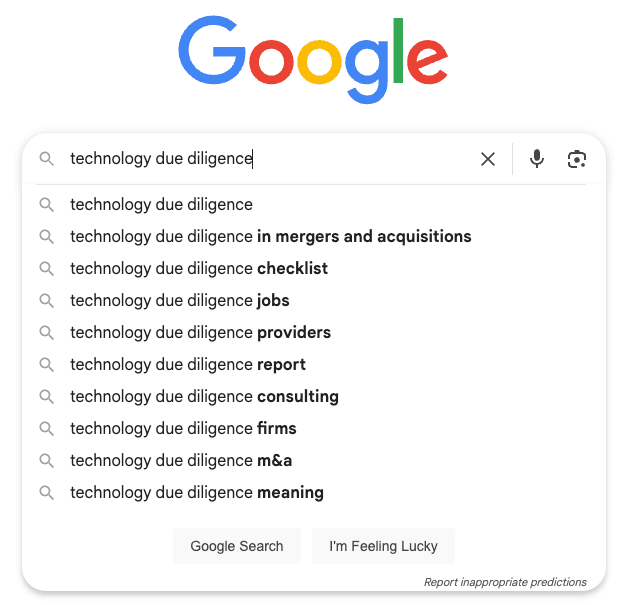

Search “technology due diligence” and you’ll find something interesting: a list of autofill suggestions that reads like a mix of curiosity, confusion, and checklists. Here’s what shows up:

- “Technology due diligence in mergers and acquisitions”

- “Checklist”

- “Jobs”

- “Providers”

- “Report”

- “Consulting”

- “Firms”

- “M&A”

- “Meaning”

And if you read between the lines, these aren’t just search terms — they’re signals. They tell us what the market really wants from tech DD. So let’s unpack what’s going on behind these searches.

1. “Technology Due Diligence in M&A” — Obvious, but Incomplete

Most people still associate tech DD purely with M&A. Yes, it’s critical during acquisition — but that’s just the tip of the iceberg. The best investors use it pre-deal and post-deal. Founders use it before a raise, before hiring, before re-platforming.

What it tells us: The market still sees DD as a one-off gate, not a growth enabler. That’s a positioning gap.

2. “Technology Due Diligence Checklist” — People Want a Shortcut

Checklists are comforting. They feel like control. But here’s the truth: most checklists are either too generic to be useful or too rigid to reflect real-world deals.

What it tells us: People want structure, but they’re afraid of missing something. A smart provider might have a checklist as a guide but won’t stick to it and will ask pertinent questions on the fly.

3. “Jobs” and “Consulting” — Talent Is in Demand, But the Role Is Unclear

People are clearly searching for roles in tech DD — but there’s no standard career path. Is it engineering? Product? Consulting? All three? (You tell me!)

What it tells us: The industry is growing, but undefined. That’s an opportunity for firms (like yours) to define what “great” looks like in a DD operator or team.

4. “Report” — People Still Expect a Static PDF

This one’s interesting. “Report” is one of the most searched terms — but in many cases, the format is broken. 80-slide PDFs packed with acronyms don’t help a board make better decisions.

What it tells us: There’s still a massive opportunity to reinvent the way DD is delivered — faster, clearer, interactive, maybe even narratively structured.

5. “Meaning” — There’s Still a Confusion About What Tech DD Actually Is

The word “meaning” is doing a lot of heavy lifting here. It suggests many people — especially first-time founders or generalist investors — still don’t know what they’re supposed to be asking for.

What it tells us: Education is still needed. The firms that win long-term will be the ones that explain not just what they do, but why it matters in plain English.

So What?

This tiny slice of Google autocomplete is telling you:

- People want clarity, not just code reviews

- They’re overwhelmed with options and jargon

- They’re searching for better ways to trust, grow, and de-risk decisions

If you’re in the business of doing tech DD (or buying it), the opportunity isn’t just to answer the question. It’s to reframe it.