Today marks the two-year anniversary of our venture. As Managing Partner of a UK-based Technology Due Diligence firm, I’ve gained valuable insights that I believe could benefit my team and our broader audience, comprising venture capitalists, private equity players, corporate investors, and tech founders or CTOs.

Initial Objectives

Our overall objective was to create a new business that disrupted, building a software-driven Professional Services firm. Of course, at times, I had doubts – software development is both time and cash-intensive. But to come out the other side is a great feeling for us all. Now, the interesting phase comes in – commerciality.

My focus was on building a trustworthy team and a positive work culture. I wanted to maintain ‘authenticity’ in our Tech Due Diligence provider role. Far from wanting to be a mere ‘clipboard holder’, I envisioned us as still relevant in technology – building and scaling technological innovation, so we’re up-to-date and on the same journey as the firms to remain insightful partners across the funding journey. As they say, you’re only as good as your last project.

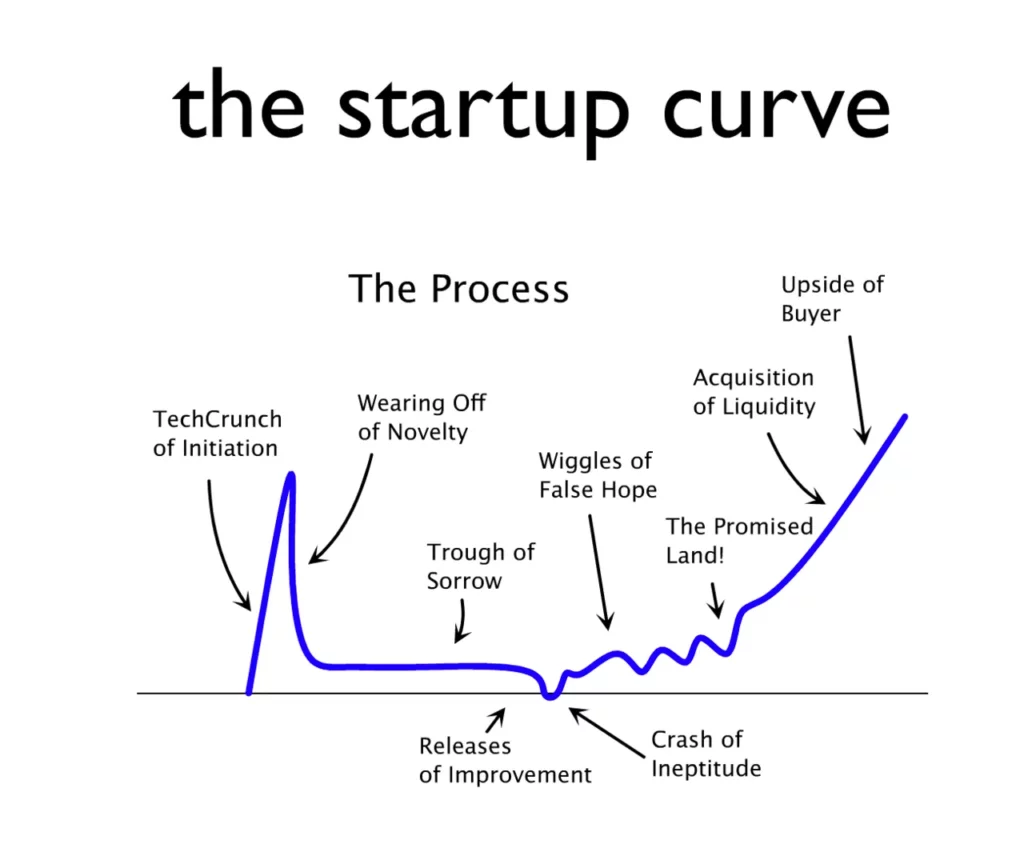

We launched our platform in September 2022, realised the issues before they became ‘market issues’, and hit the infamous ‘Trough of Sorrow‘.

Using the Amazon six-pager process (I am a big fan), I concluded, after research, that focus team culture would get us through. Especially hard to do when there’d been an issue with the Government’s budget. We are a stronger team for it; the team actually reads and discusses those six-pagers now.

To support the overall objective, we engaged in numerous courses. Notably, the Robot Mascot course on Pre-Seed fundraising and the Mountside Ventures course on Seed/Series A stages were transformative, offering granular insights into the challenges both investors and founders face. We were not looking for funding but learnt everything about it we could.

Why did we focus on early-stage start-ups when working with mid-cap and corporate?

- Alignment: We’re on the same journey and understand the environment and challenges firms faced during this period.

- Lack of Product Market Fit: You know that pain.

- Challenge: As one investor stated recently, referring to AI, not commercial matters: “The issue with early-stage tech firms isn’t deployment. It’s math.”

The Artificial Intelligence course at AiCore was another eye-opener. Harry Berg is an excellent teacher and founder; the community around it is impressive and from all walks of life.

Over time, we grew our practice, partnering with Microsoft to host our solution and being accepted as a Microsoft Founder Hub and a Microsoft ISV Success partner. This worked out well as we’re using the best tech components for data science and the best hosting provider for Artificial Intelligence tools with access to OpenAI and various AI Studios.

Now you have the objectives, let’s dive into the top three takeaways:

1. Pick a Good Market

In 2017, I learned the advantages of focusing on a niche. From that learning, we zoned in on providing Technology Due Diligence services to a specific clientele, namely investors (VC, PE, and Corporate). This is supported by Bain & Co’s report that only 9% of M&A deals utilise Tech DD. This clarity in messaging reaped benefits: it aided our marketing efforts and brought us inbound opportunities without relying on ad spend.

However, our market assumptions took a hit 18 months in, particularly due to shifts in the UK budget and hiring landscape, and we learnt good reasons why only 9% of deals use technology due diligence.

The lesson? Always ‘pick a good market’.

In fact, it is a recurring theme in every Technology Due Diligence report we prepare. Beyond technology, it’s essential to be commercially-led, focusing on what customers want and keeping costs in check.

2. Problem Discipline Over Product Discipline

Thanks to Uri Levine, the founder of Waze, and his illuminating book, “Fall in Love with the Problem, Not the Solution,” this lesson was underscored. Instead of approaching Product Development from a solution-centric standpoint, pivoting to a disciplined problem-solving framework creates better customer dialogue.

This perspective change can mean the difference between success and failure for tech startups. Being problem-focused enables a simpler, faster route to market, ensuring that tech investments are justified by tangible customer needs. Focusing on problems, just like in sales conversations, forces you to arrive with questions, not answers.

3. Building a Tech-Enabled Product vs. a SaaS Product

Our initial aim was to be a tech-enabled firm, and accordingly, we launched our product in September 2022. However, we soon realised that while the product catered to our specific needs, it wasn’t ‘Enterprise-ready’. A broader focus and more extensive UX discipline were required to scale as a Software as a Service (SaaS) platform.

Essentially, what worked for us, based on our internal logic and flow, was not universally applicable. The transition from being a tech-enabled firm to a SaaS platform involves nuanced changes in focus and execution. Thanks to supportive friends, customers and partners who helped us identify the problem – and for those trying to adapt their tech-enabled product to a SaaS offering – we understand the temptation but note it’s a challenging journey (but not impossible).

In Summary: The Virtue of Simplicity

In all aspects—be it product development, team dynamics, or client interactions—the acronym KISS (Keep It Simple, Stupid) serves as a golden rule. Simplicity fosters understanding, builds trust, and, in many ways, is the cornerstone of sustainable success.

Simplicity is scalable.

So, as we celebrate this milestone and gear up for the future, it’s this spirit of simplicity and continuous learning that we wish to carry forward. Here’s to many more years of solving problems, innovating, and maintaining the trust and quality that our clients, partners and staff have come to expect.