The Reality of Minimal Defensibility in Tech

A key investor question over the past decade has been the defensibility of the tech within a firm. Concerned with a target’s (unique) offering and the risk of others copying. For those who watch Shark Tank/Dragons Den, it’s always entertaining to watch entrepreneurs respond to this line of questioning.

Our slightly anarchic response is that it doesn’t matter.

Take this week’s events.

The recent surge of news and market reaction to the release of DeepSeek says it all: when it comes to technology, there’s minimal defensibility. If the product or service you’re investing in is a form of digital technology, it can be copied. We tell all investors this, especially since competitors with deeper pockets or more drive are always a looming threat.

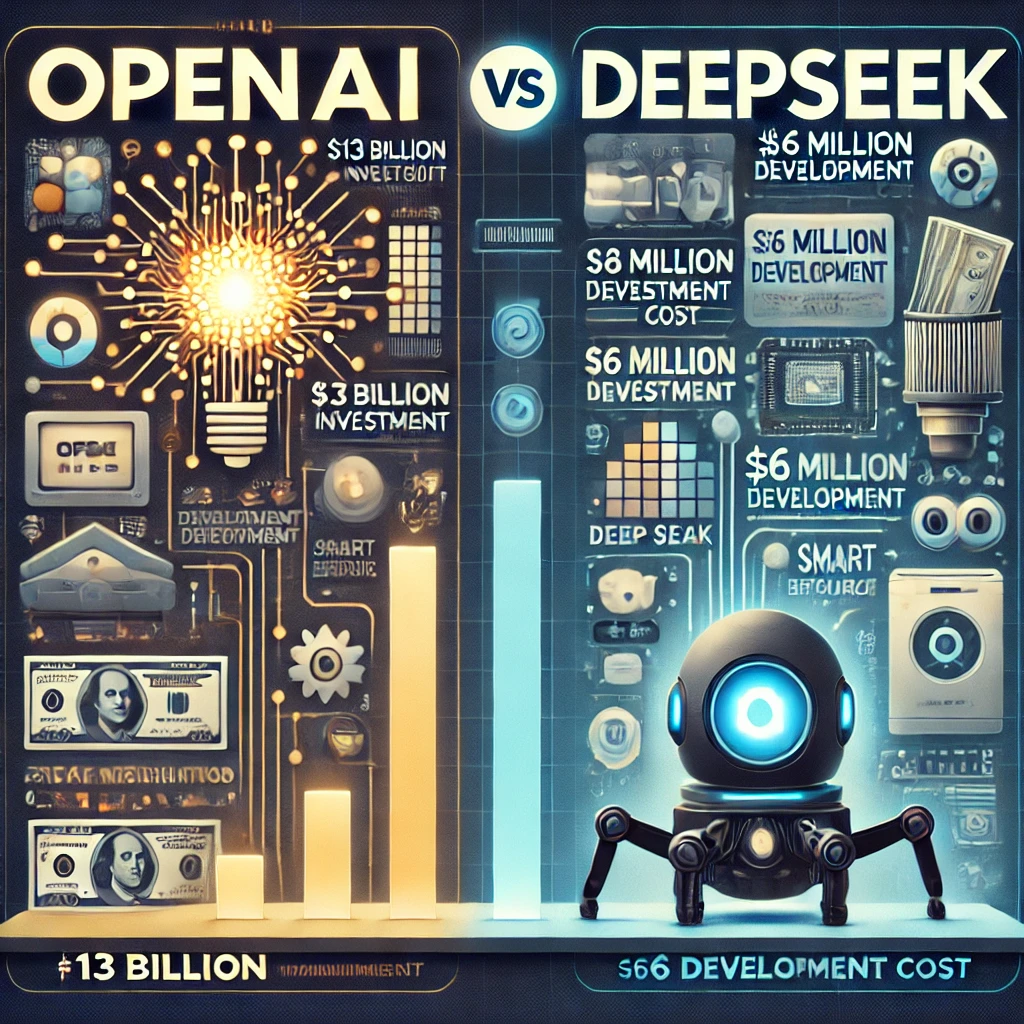

The Advantage of Second Entrants

One of the most striking observations is how the second entrant in a market often benefits enormously from the first entrant’s risk-taking and massive R&D investment. Take OpenAI, for example. They’ve captured the limelight, ushered us into the era of chat interfaces, and even popularised the term “LLM” in everyday parlance. Microsoft effectively invested $13 billion in a 49% profit-sharing agreement with OpenAI, valuing it at $157 billion. Then along comes DeepSeek, building its model for a fraction of the cost—just $6 million. (I cannot evidence these numbers but they make sensational visual storytelling!)

Shifting Focus in Tech Due Diligence

In tech investments of the past, we would spend considerable time scrutinising a company’s moat, especially around its product. This often spilled into commercial due diligence as we assessed competitors and dove deep into the technology: how it was built and how easily it could be replicated.

Today, we’ve shifted our perspective. We start with the assumption that the technology itself is easy to copy and instead focus on other forms of defensibility, such as:

- Partnerships and Integrations: What relationships has the firm fostered, and what tech partnerships or integrations are embedded in the platform? Integrations are notoriously time-consuming, painful to replicate, and a strong indicator of cooperation. In some cases there’s only room for one partner which helps secure the business.

- Strategic Connections: Who does the firm know that others don’t? For example, we recently worked with a company that had direct relationships with the management teams of both Android and Apple app stores. This enabled them to release software into ecosystems where such approvals are often denied.

- Research and Innovation: What specific research has the team absorbed and utilised? How are they leveraging that research? This is particularly critical in AI, where genuine R&D and innovation are the cornerstones of progress.

Efficiency in Rebuilding Technology

The second time around, building becomes far easier. I’m reminded of a digital bank that initially took 1.5 years to build with a large team but lost its FSA application and had to start over. Despite the setback, they reduced the rebuild timeline to just one month, using an external consultancy. With this context, it’s no wonder there’s such a dramatic difference in expenditure between OpenAI and DeepSeek.

Key Stats for Investors to Consider

- 70% of startups fail due to scaling too quickly or being outcompeted by better-funded entrants.

- The average R&D spend for a mid-sized tech company is ~25% of revenue, highlighting the cost of innovation.

- Firms with strong partner ecosystems report 1.5x higher retention rates than those without.

- Companies with exclusive industry connections or strategic partnerships can accelerate market entry by up to 40%.

A Nuanced Approach to Scalability, Reliability, and Defensibility

For investors, scalability, reliability, and defensibility remain central concerns in Technology Due Diligence. However, none of these can be evaluated in isolation or via a simple checklist assessment —nuance and context are crucial for each area.

Observations and reporting of this type require a firm, opinionated stance to make sure you make informed decisions. In an era where copying technology is almost inevitable, understanding where true defensibility lies has never been more critical.

It will be fascinating to see how these AI behemoths will fight it out, but ultimately, as per our number one rule internally – market trumps tech.