During Tech DD interviews, we’ve witnessed the differences between the needs of private equity and trade buyers.

This is especially true when considering the ‘type’ of the buyer during a vendor Tech DD. Where the firm is getting ready for sale/investment and considering interest from both PE and strategic or corporate buyers.

The key objective of this post is to ask you to burst out of the ‘bubble’. Get out of your comfort zone and explore plans for quicker growth.

A brief video summary can be watched below:

Simply put, what will be assessed and what matters to the investors (beyond revenue and growth) will differ.

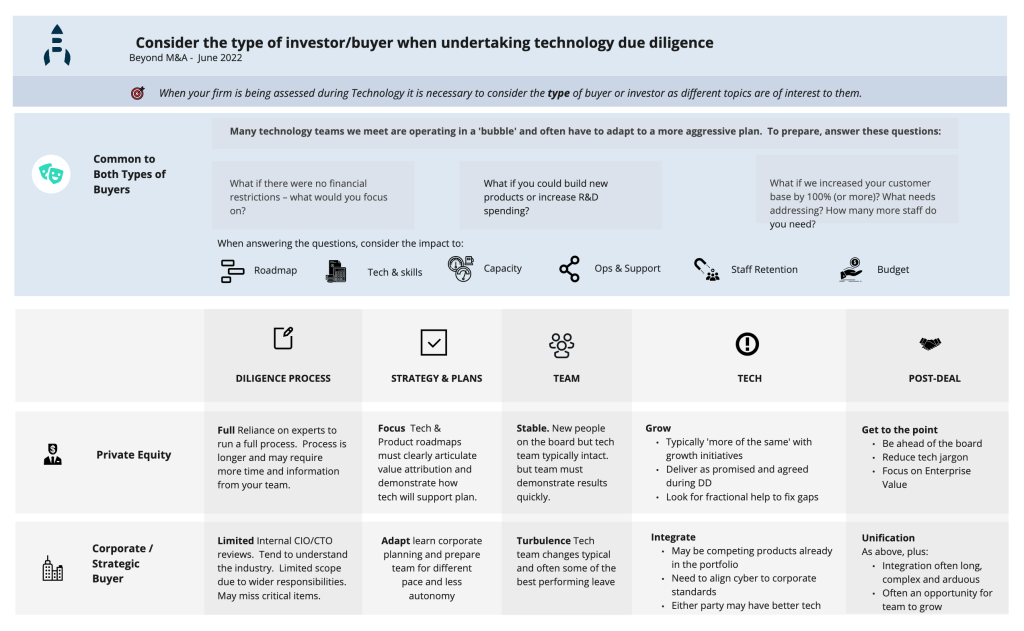

So, I will explain the key differences to ensure you’re prepared and present accordingly. For those who prefer a summary, it is presented in the diagram below:

Living in a bubble

Before delving into both types of investors, many teams we meet pre-deal operate in a bubble. They believe the growth plan, reporting and KPIs they have today will suffice post-deal.

And then the deal goes through, and the pace changes rapidly.

Suddenly, the growth plan becomes more aggressive, which is not bad as long as you’re prepared.

For instance, one of our team members was involved in a start-up as the fourth employee. They built something that took off. As a result, they grew from four people to six hundred and fifty in eighteen months.

In that example, the acceleration is so fast that everything needs reconsideration. Especially the software development processes, the ease of onboarding developers and how you manage security and release management.

And the overhead of interviewing a ton of people!

So my suggestion is to consider your scaling plans and consider ‘what if’ situations:

- What if there were no financial restrictions – what would you focus on?

- What if you can build new products or increase R&D spending?

- What if your trade buyer or PE Investor increased your customer base by 100% (or more)? What needs addressing? How many more staff do you need?

The key output from these questions is understanding scaling opportunities, challenges and associated spending.

All are helpful to present during Tech DD to demonstrate you’re looking beyond the deal.

Tech DD, when working with Trade Buyers

Trade buyers are typically larger companies in the same industry as your company.

They want to acquire businesses that will complement their existing product offerings or help them enter new markets.

In addition, they often already know your market, so less time is spent getting to know it. Hence, the diligence process can be quicker.

Trade buyers tend to be more interested in the technology and IP of the target company. Plus, they want the technology to provide additional value to their customers.

They’re also more likely to keep the target company’s management team in place.

Tech DD may be reasonably informal, depending on how acquisitive a firm is.

For instance, the buyer’s CIO/CTO/Architect may assess the tech and team over a short period. That exec has a much bigger firm to run, so they have limited time to evaluate your tech.

Potential issues with trade-buyer Tech DD

An exec performing Tech DD is a dual-sided sword.

On the positive, they won’t have the time to dig too deeply. But if important aspects are missed, they can cause issues post-acquisition, often leading to challenging ‘them and us’ situations.

I think this happens because of the assumptions made on both sides.

- Trade buyers ultimately assure you that your team will be in safe hands. During Tech DD they may want to demonstrate that they have “been there, done that“. To show they are highly experienced in M&A .

- And the target firms being acquired believe this to be true. So they let the buyer take the lead and assume that enough information will be collected and examined.

With both parties thinking the other misled them.

Example Case Study

The worst case I’ve experienced was when assumptions had been made about a small firm tech firm during acquisition. It was only two hundred staff, so the management guesstimated the tech based on a few answers from management.

Post-deal, it turned out to have a huge tech, complicated tech stack and the two-month integration quadrupled.

Everyone was under immense pressure and always on the back foot in that situation.

- The buying firm’s CIO had to explain why integration was constantly delayed to the board.

- The target firm’s management wasn’t trusted. As it was assumed, they didn’t disclose everything during DD (The reality is, they were not asked).

- They ended up spending a fortune on consultants.

Leading to a high level of ‘them and us’. Additional expense – the three-month integration project took nine. And generally, a very unhappy place to work.

It was all down to trust issues. But really due to both sides making assumptions.

Suggestions for Trade Buyer Tech DD

During the due diligence period, it’s easier to request funds to address problems than it is post-deal.

So, if you are being assessed by a trade buyer, I would advise disclosing the necessary information. As it will be found after the deal if not.

A trade acquisition like this is a long-term marriage, and it’s worth starting on the right foot.

I’ve witnessed so many of these go wrong.

So there are a few things for you to consider if a trade transaction is on the horizon:

What is the acquirer’s intention?

You need to understand the strategic intent of a potential acquisition/investment. You may not be able to ask this question during the assessment. But you can research prior acquisitions online.

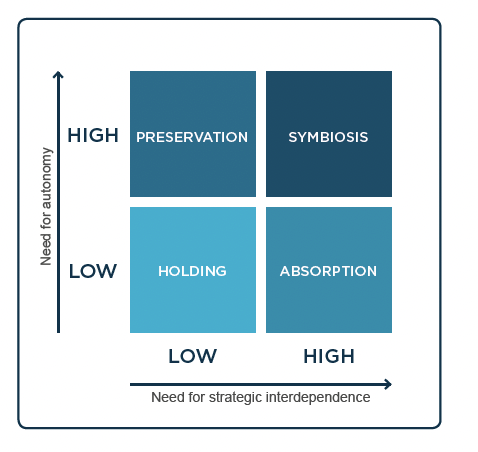

Ultimately, the buyer’s overarching strategy is to decide whether to absorb the target business to follow their ways of management. Or should the target preserve its management culture? Or maybe a mish-mash of both companies?

Haspelagh and Jemison’s classic model below helps teams understand the four choices regarding M&A integration.

The model suggests there are four distinct strategies that buyers may be following as they acquire companies:

Preservation

Preserving the acquired company, effectively leaving it as a stand-alone brand and operation. In this situation, your business, and therefore your tech, runs independently post-deal.

Symbiosis

Looking for cross synergies. In fact, many businesses opt for the mish-mash option where they believe that they

can adopt each other’s better practices and have a better process.

Absorption

Full integration of the acquired business, technology and teams to sit under a single brand.

Holding

We used to run M&A integration courses with our good friend Anirvan Sen pre-pandemic.

It was fascinating to see highly-experienced M&A integration attendees look at the H&J model and identify where their firm sat. Typically they were in ‘Holding’, i.e. no clear strategy.

You can read more about the Haspelagh and Jemison model, and the headline sums it up nicely:

Better management of the pre‐acquisition decision‐making and the post‐acquisition integration processes can improve an acquisition’s potential to contribute to strategic renewal.

The challenge of renewal through acquisitions, Philippe C. Haspeslagh, David B. Jemison

Whilst this may not seem a concern for Tech DD, knowing the trade buyer’s M&A integration strategy is hugely beneficial. It allows you to review and revise your tech roadmap accordingly. This may lead to a better outcome for all post-deal.

Is the technology to be left standalone as its brand or to be integrated?

As a follow-on, it is worth considering the intention for the technology offerings. Your company has built IP others are prepared to pay good money for.

If integrating, how successful have they been in the past? And is it a good idea to integrate the companies in the first place?

What products or elements of your tech stack are superfluous to needs?

If the trade buyer is already offering similar products or acquired similar firms, this could lead to redundancies.

Unfortunately, there isn’t much you can do to avoid this – making such cuts will be part of the investment thesis.

We have seen tech leaders try and overcome this by justifying the existence of team members. Often by increasing the maintenance ratio (i.e. presenting a need for certain people to keep the lights on).

But this is to shoot oneself in the foot. As it will raise questions about the quality of your products and why they need so much upkeep. They may think that you have inferior or buggy offerings.

Be ready for change.

You can watch this video to learn more from (post-deal) M&A stories from a trade/corporate buyer perspective:

Tech DD, when working with Private Equity

On the other hand, private equity firms are usually looking for companies they grow and sell on. The assumption is they tend to be more interested in the target company’s financials than tech.

However, technology increasing impacts the value creation plan hence the growth in technology due diligence.

Suppose the investment/acquisition of your firm is a bolt-on to an existing portfolio firm. In that case, the ‘trade buyer’ notes above are more relevant, especially if the buyer is already in your market. If not, then read on.

It is possible the PE Investor has less knowledge of your industry vs. a trade buyer.

Hence the Tech DD approach is more comprehensive. It has to cover a wider scope and the results are more formal. The report has to present a layman’s narrative of your tech, scalability, risks, opportunities etc.

This is because many non-technical parties (banks., lenders etc.) will read the technical report as part of their risk-assessment process.

The roadmap needs validation to be driving value

Luckily unlike a trade buyer, you don’t have the same four-step Haspelagh and Jemison’s model / end-stage options.

Unless it’s a platform ‘buy and build’ scenario. It is more likely your brand (and therefore tech) will be preserved, there are few of integration concerns.

You will need to present a clear technology roadmap. The roadmap must articulate both your strategy and the contribution to the growth plan.

We often work between investors and portfolio firms post-deal to determine ‘what went wrong,’. The issues are often due to a misunderstanding of expectations from the outset.

So you may have to re-assess your in-flight projects. I suggest focusing on areas of certainty and addressing long or ongoing initiatives – before someone tells you to.

The pace will increase. Rapidly.

Our experience working with tech leaders is many won’t have prepared for how much the pace will suddenly increase post-deal.

The pace increase will depend on many factors (e.g. product integration, new customers etc). Because initiatives to make the most of the perceived value in the firm will take off almost immediately.

Tech management can be cash-constrained pre-deal. Post-deal, cash is no longer a problem. But there are occasions when management isn’t ready to deploy the cash.

Plus. everyone is checking each other out post-deal.

The new board will have high expectations – based on promises made pre-deal. And you don’t want to be perceived as the ‘typical tech guy’.

So, a suggestion is post-deal, ensure you keep on top and ahead of your board.

This means creating and maintaining a clear strategy and roadmaps. Ensuring you explain the financial returns of your efforts in detail.

Ensure the pack is easy to comprehend and align your roadmap with business growth plans. You want to ensure the tech team’s contribution to business growth is continually pitched to the board.

More Governance and Expectations

Even if the business and tech are preserved, the team probably won’t be.

Additional members or other trusted sources/turnaround CEOs may come on board. Especially if the founder(s) are leaving the business as part of the deal.

Therefore it is wise to consider the issues you already know of within the team. And what needs to be done to fix them.

Because you don’t want to be on the back foot. Trying to explain why something wasn’t delivered on time or issues occurred now that you are under more scrutiny.

To summarise: ensure you align your narrative to the type of buyer you’re meeting with

This recommendation relates to both types of buyers.

Of course, when I state narrative, I am not suggesting you fabricate a story. But it is worth sitting in the investor’s shoes for a moment and understanding what interests them.

In both cases, it is wise to consider the impact of more aggressive growth plans. And identify where work is needed in the tech team to support rapi growth.

I tend to find teams are more excited about a Private Equity backed buyout than trade often because they will continue to operate as-is and still grow the firm/technology as per the original intentions.

But in either case, they are often an opportunity to grow.

Here are some last recommendations:

- Understand your buyer’s intentions and what’s of interest to them

- There are differences if it’s a trade buyer vs a PE investor. Hence your responses will need to be tailored to that audience.

- Be prepared for and plan what will happen once the deal goes through

For related information, these articles may also be of interest to you:

Tech DD – What Do Investors Want?

Tech Due Diligence – Essential Success Factors

Adapt your technology strategy following a management buyout