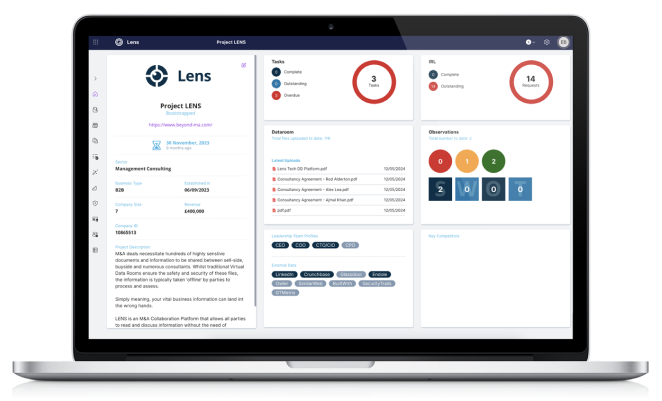

We engaged Beyond for technical due diligence, and their expertise was outstanding. They provided thorough, insightful, and actionable assessments, ensuring our investment decision was well-informed. Their professionalism and attention to detail exceeded our expectations, making them an invaluable partner in our due diligence process. Highly recommend!