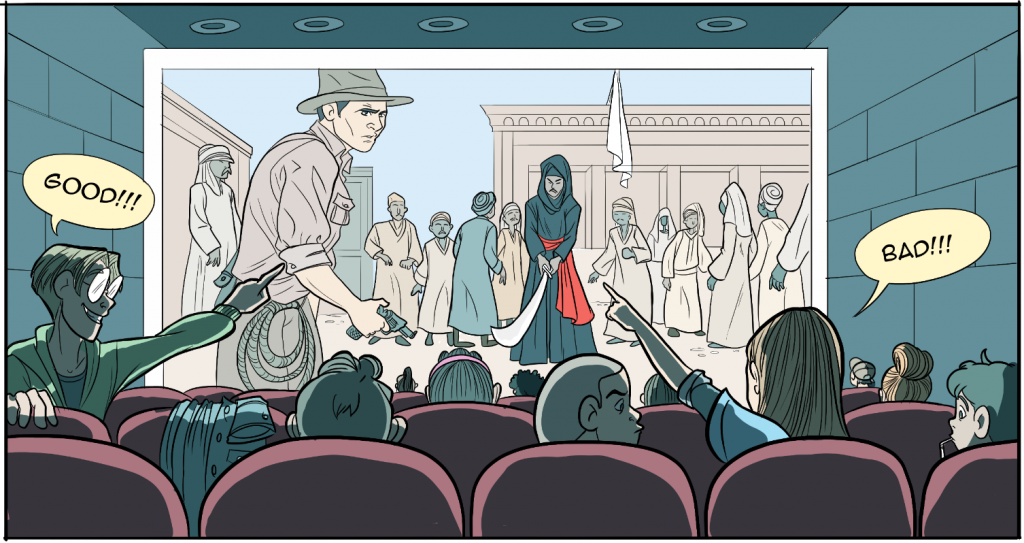

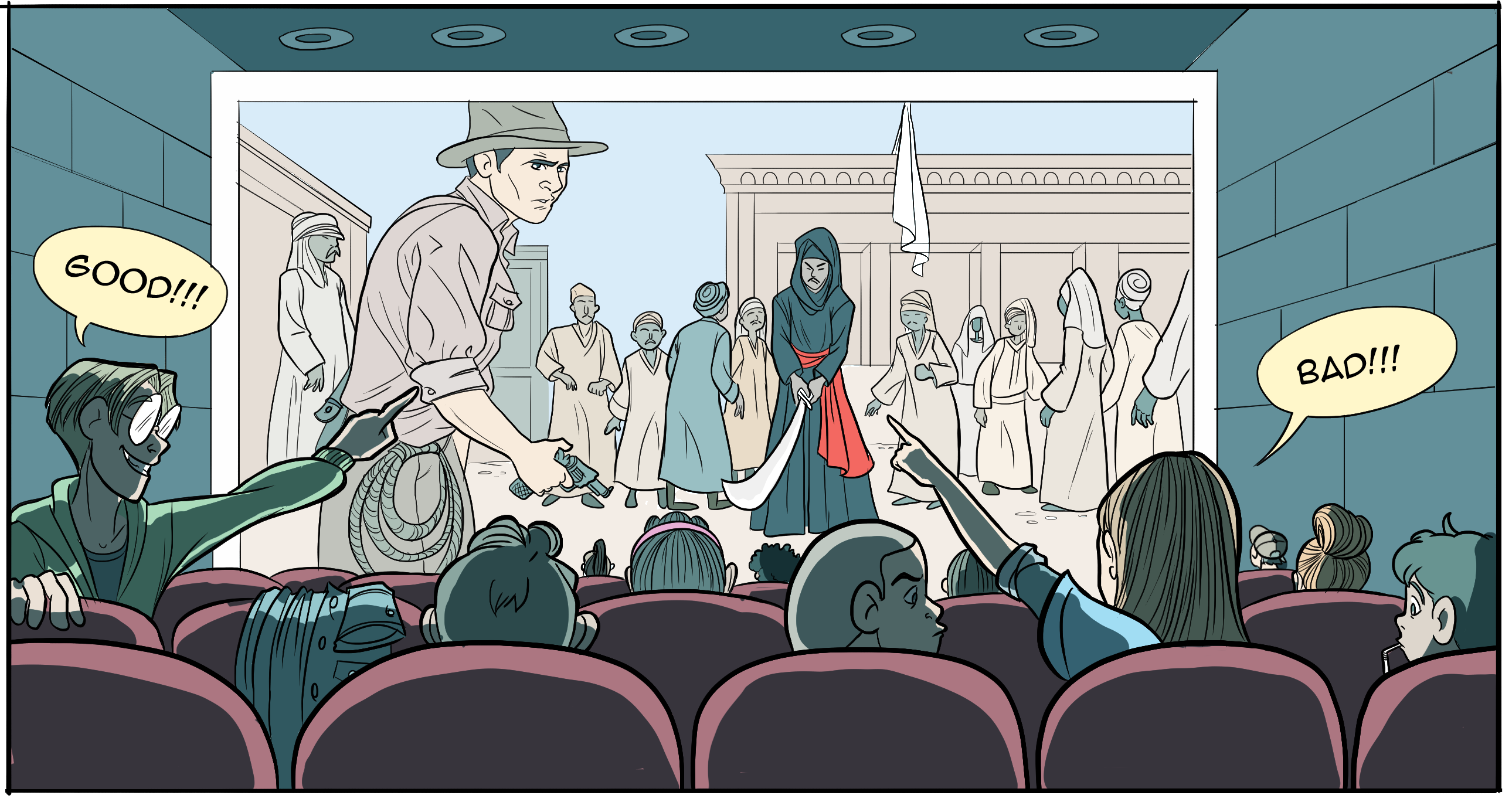

The first semester of studying film and screenwriting was exciting, and one teaching technique stands out a decade later. A group of 20-30 of us visited the cinema at the British Film Institute weekly, and a film was projected, often very well-known movies and blockbusters. For this example, let’s use the Raiders of the Lost Ark.

Every two to five seconds, the film paused.

The tutor would ask us “tell me what you saw”.

Every hand would shoot up (after all, this was adult education, we’re paying for it, and passionate about the subject). Everyone keen to share interpretations of what they’ve just seen.

Often, this would be our opinions on who is “good” versus “bad”, the intentions of the characters, how the characters were feeling, what they might do next etc. All of us were different ages, from different ethnic and social backgrounds. Hence, the feedback was based on our experiences, education, values etc.

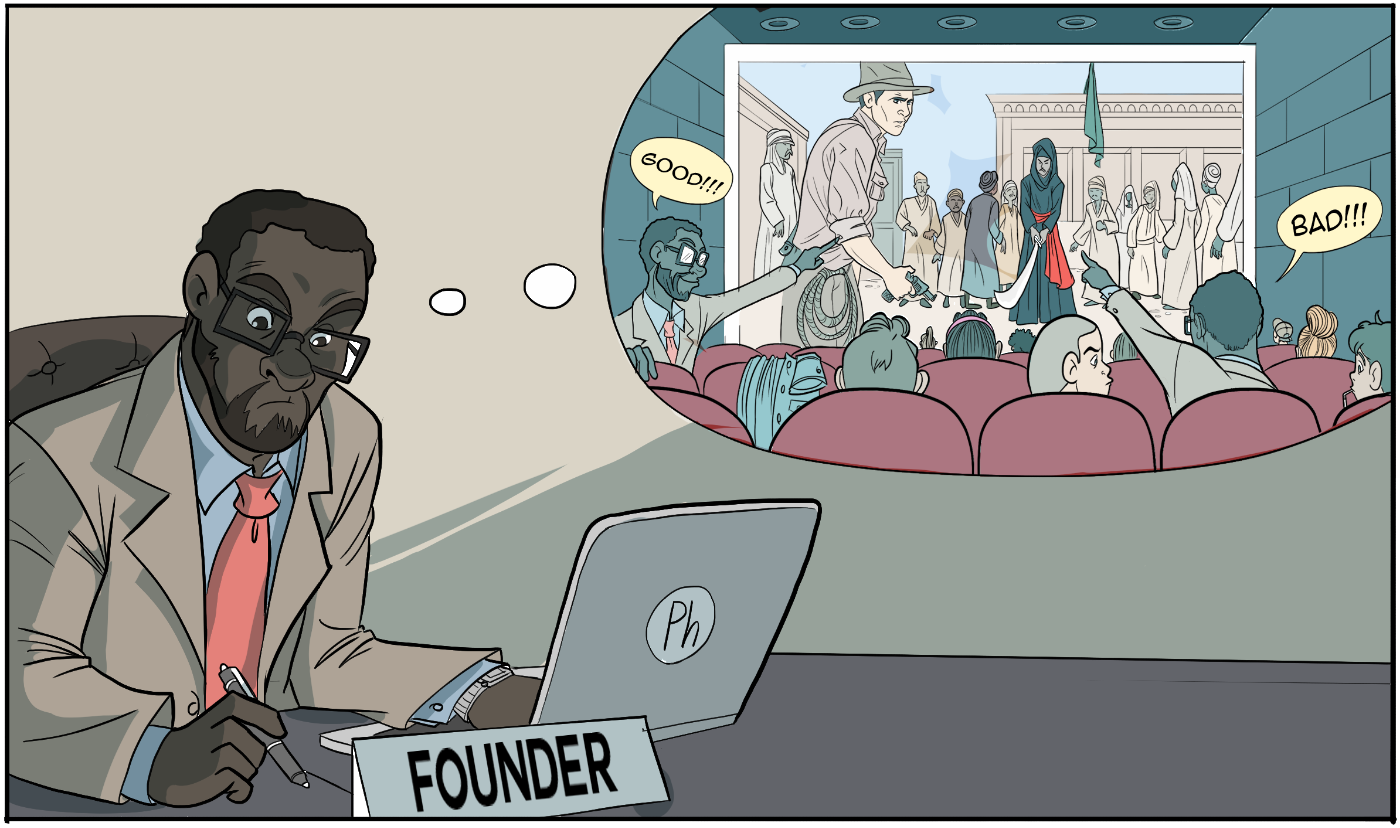

These snippets of film we watched were short, but easily generated 10-20 minutes of conversation. What we learnt was the use of stereotypes in cinema – but also how quickly we recognise those stereotypes and then how easily we put people into pigeon-holes. Indiana was “heroic” and his perpetrators less so. Yet looking back, every week we were witnessing a live demonstration of unconscious bias.

Bias in the workplace

We see that happening at the workplace too. There are plenty of excellent blogs on the subject of unconscious bias. But can it be measured?

One way is to look your existing team. Who have you hired today and how did they get here?

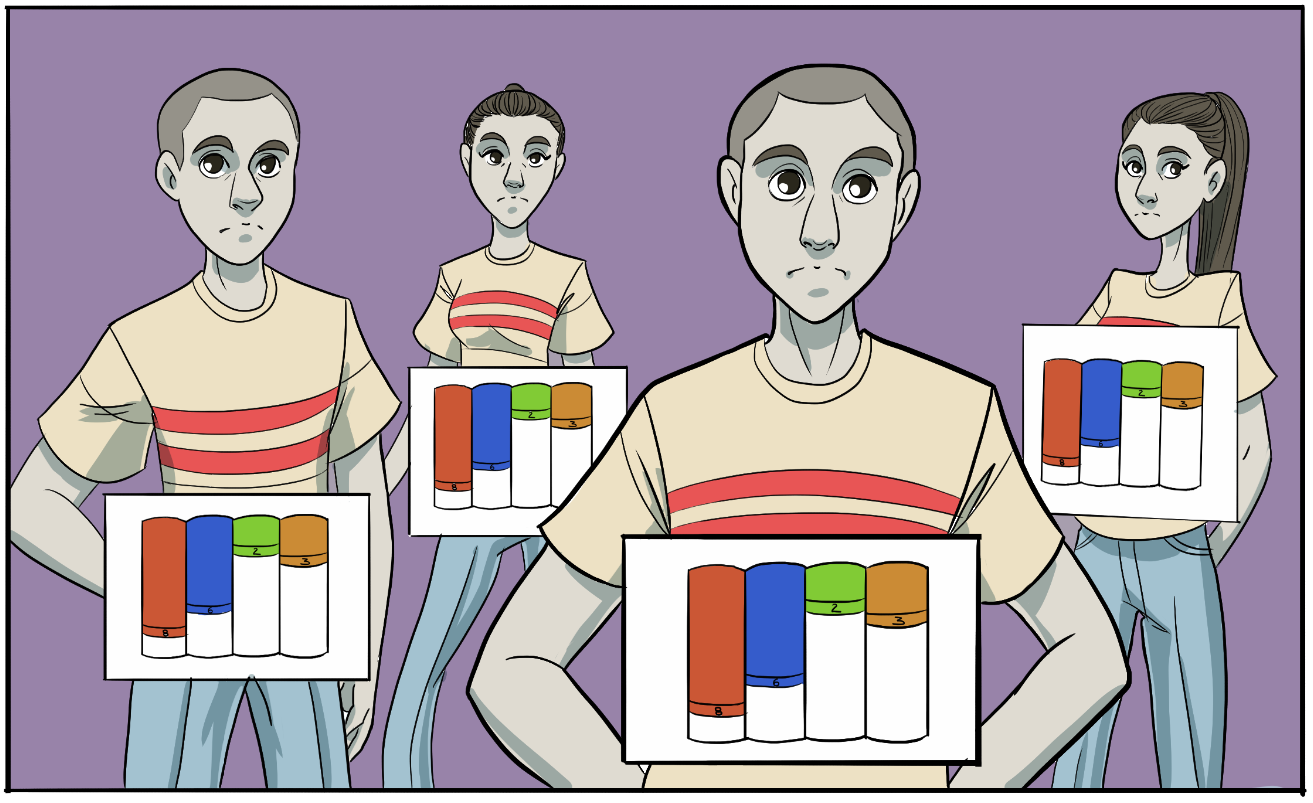

For example, we worked with a software development business of 50 staff who wanted to assess how they could be more impactful for their clients. So we ran conative assessments and found regardless of age, gender, background and ethnicity 88% of them had exactly the same profile. Put it another way, under stress 88% of them would behave exactly the same way.

Remember this is an entire business – covering the key areas of sales, marketing, product and operations – so ideally people need to be “different” in order to ensure the business operate optimally.

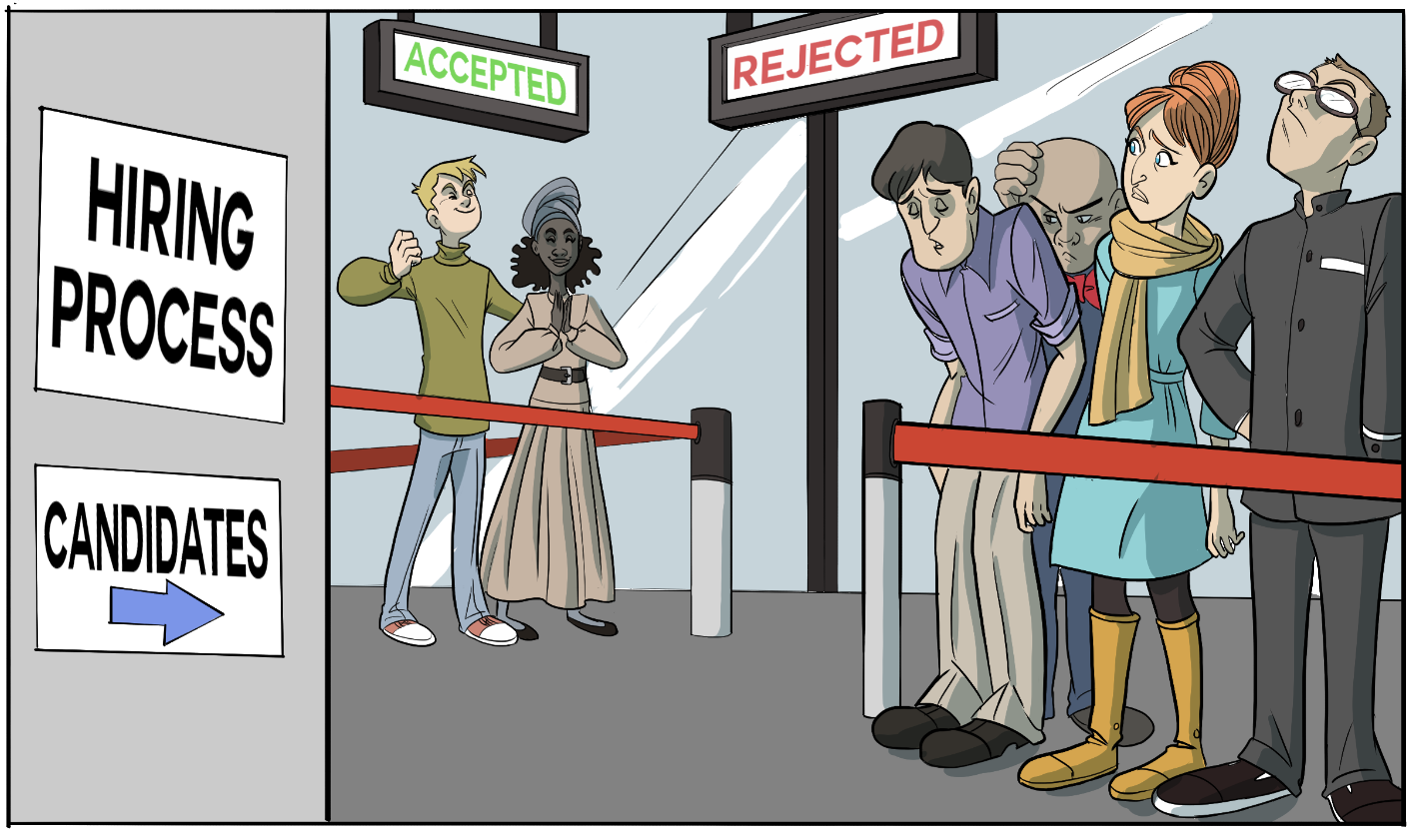

As they’d quickly identified they are hiring clones, the next area to look at for bias in the hiring process. Not surprisingly, all of the staff had come from precisely the same pool, using the same interviewing techniques. Any “anomalies” were quickly sifted out.

And when we took it back one more step, to find that conative profile they are hiring is very similar to the founder and that the interview process, and it’s rules of selection, originate from him. No wonder they are “hiring clones”.

Of course, sometimes it essential to hire people of (almost) exactly the same type, mainly when they perform the same role. And being “diverse” isn’t critical to success – as shown by this founder who had built a stable business.

But the requirement was to improve ideation, product and sales for the business they needed to challenge their own biases to change how they hired. And to do this, we needed a measurement of where those biases were.

We can’t always help having biases in the workplace but it’s possible to measure them in a professional manner and remediate the siutation.

{{cta(’23b74a59-42a2-4a7c-8ded-6111a29634b7′)}}